V5 Inc Exc PS

Introduction: Why People Search for V5 Inc Exc PS

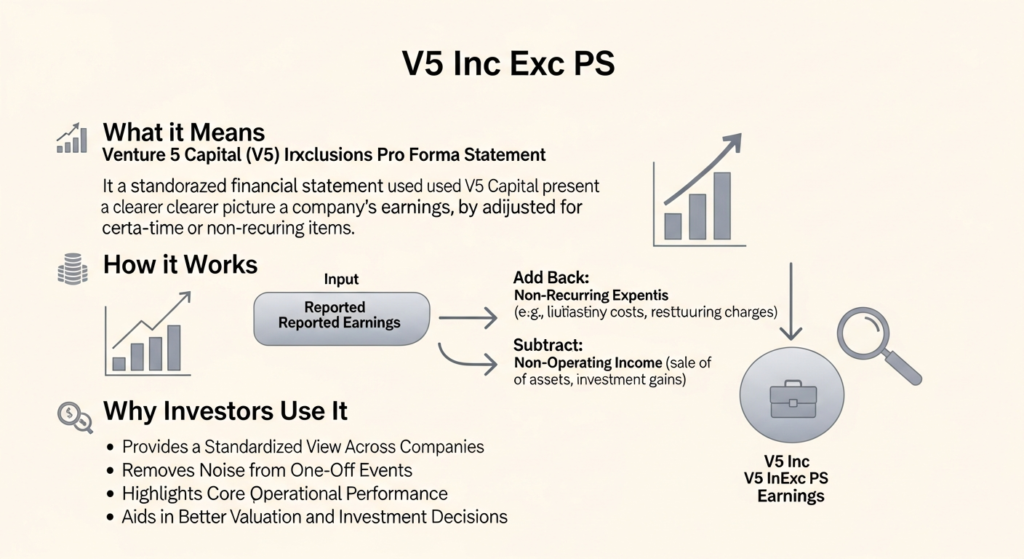

Many people see the term V5 Inc Exc PS on finance websites and feel confused. This keyword mostly appears in stock data, company analysis tools, and investor platforms. The reason people search for it is simple. They want to understand a company’s real earnings without noise. V5 Inc Exc PS focuses on income per share while excluding unusual events. These events can make profits look bigger or smaller than reality. This guide explains everything in very simple language. No complex finance words. No confusion. By the end, you will clearly understand what V5 Inc Exc PS means, why it matters, and how it helps investors make better decisions.

What Is V5 Inc Exc PS? (Simple Meaning)

V5 Inc Exc PS is a financial metric used to measure a company’s income per share after removing exceptional items. “V5” usually means the value is reviewed across multiple periods. “Inc” refers to income. “Exc” means excluding unusual or one-time items. “PS” means per share. When all parts come together, the metric shows clean earnings per share. It avoids misleading profits caused by rare events. Investors trust this number more because it reflects normal business performance. In simple words, V5 Inc Exc PS tells you how much money a company truly earns for each share.

V5 Inc Exc PS – Quick Explanation Table

| Aspect | Explanation |

|---|---|

| Full Term | V5 Income Excluding Exceptional Items Per Share |

| Purpose | Show real and stable earnings per share |

| Removes | One-time and unusual income or losses |

| Used By | Investors, analysts, and finance platforms |

| Best For | Long-term company performance analysis |

| Risk | Possible misclassification of exceptional items |

| Comparison | More stable and reliable than basic EPS |

What Does V5 Inc Exc PS Mean in Real Life?

In real life, companies sometimes earn money in unusual ways. For example, selling land, winning a lawsuit, or paying a one-time penalty. These events change profits but do not repeat. V5 Inc Exc PS removes these unusual events. This helps investors see stable income. Imagine checking your monthly salary but ignoring a one-time gift. That gives a clearer picture of your real income. The same idea applies here. This is why V5 Inc Exc PS is useful for long-term analysis and planning.

Why Investors Pay Attention to V5 Inc Exc PS

Investors want numbers they can trust. Regular profit figures can be misleading. A company may look strong due to a rare event. V5 Inc Exc PS fixes this problem. It focuses only on normal income. This makes company comparisons fair. Long-term investors rely on this metric to avoid emotional decisions. It helps them stay calm during market noise. That is why professional investors and analysts value V5 Inc Exc PS.

How V5 Inc Exc PS Is Calculated

The calculation behind V5 Inc Exc PS is logical and clean. First, the company’s total income is taken. Then exceptional items are removed. These items include legal settlements, asset sales, or restructuring costs. After that, the remaining income is divided by total shares. The “V5” element ensures the number reflects consistency over time. This process creates a stable and trustworthy metric. Investors prefer this method because it removes distortion and highlights true performance.

Difference Between EPS and V5 Inc Exc PS

EPS shows earnings per share but includes everything. This can be misleading. V5 Inc Exc PS removes one-time items. EPS may rise suddenly due to a rare gain. That does not mean the business improved. V5 Inc Exc PS avoids this confusion. It shows quality earnings. That is why many investors consider it a better long-term metric than basic EPS.

Role of Exceptional Items in Company Profits

Exceptional items are unusual events. These may include selling assets, legal fines, or business restructuring. These events affect profits but do not reflect daily operations. Including them can mislead investors. V5 Inc Exc PS removes such items. This helps create clean financial data. Clean data leads to better decisions. Understanding this role is key to trusting financial reports.

How Analysts Use V5 Inc Exc PS

Financial analysts use V5 Inc Exc PS to evaluate company health. They use it for forecasting and valuation. Clean earnings help predict future growth. Analysts often use this metric in reports. Investors trust analyst opinions more when data is clear. This is why V5 Inc Exc PS plays an important role in professional analysis.

Is V5 Inc Exc PS Useful for Beginners?

Yes, beginners benefit greatly from V5 Inc Exc PS. It simplifies earnings analysis. Beginners often panic due to sudden profit changes. This metric removes confusion. It promotes long-term thinking. Learning it early builds strong investing habits. It also improves confidence. Beginners feel less overwhelmed when they understand clean numbers.

Common Mistakes When Understanding V5 Inc Exc PS

One common mistake is using V5 Inc Exc PS alone. No metric should be used alone. Another mistake is ignoring company notes. Some companies classify items differently. Always check details. Investors should combine this metric with revenue and cash flow. Used correctly, it becomes powerful. Used blindly, it can mislead.

Real-World Example of V5 Inc Exc PS

Imagine a company sells property and earns a large profit. EPS jumps. Next year, profits drop. Investors feel confused. V5 Inc Exc PS would have ignored that sale. It would show stable earnings. This example shows why this metric matters. It prevents false expectations and reduces risk.

How V5 Inc Exc PS Helps in Company Comparison

Comparing companies of different sizes is hard. Raw profits do not help. V5 Inc Exc PS allows fair comparison. It focuses on earnings per share. It removes unusual income. This makes analysis easier. Investors can compare companies more accurately. That is why it is widely used in stock analysis tools.

Pros of V5 Inc Exc PS Explained Clearly

The biggest advantage of V5 Inc Exc PS is clarity. It removes noise from financial data. It helps investors understand real earnings. It supports long-term thinking. It improves comparison between companies. It reduces emotional reactions. These benefits make it a trusted metric among analysts and serious investors.

Cons of V5 Inc Exc PS Explained Honestly

The main limitation is interpretation. If exceptional items are classified incorrectly, results may change. Some investors may rely on it too much. It should never replace full financial analysis. It is a tool, not a guarantee. Understanding this keeps expectations realistic.

Limitations of V5 Inc Exc PS

No metric is perfect. V5 Inc Exc PS depends on correct classification. Some companies may adjust figures aggressively. Investors should stay alert. It should be combined with other metrics. Still, it remains one of the most reliable tools for clean earnings analysis.

Why V5 Inc Exc PS Is Important for Long-Term Investing

Long-term investors care about stability. Short-term noise does not matter. V5 Inc Exc PS supports long-term thinking. It removes temporary effects. It highlights real business strength. This helps investors stay patient. That is why long-term portfolios often rely on clean earnings metrics.

Final Thoughts on V5 Inc Exc PS

V5 Inc Exc PS is a powerful and simple metric. It removes confusion. It highlights real income. It supports smarter decisions. Beginners and professionals both benefit from it. When used correctly, it builds trust. Understanding this metric improves financial clarity. If you want to invest wisely, learning V5 Inc Exc PS is a strong step forward.

Frequently Asked Questions (FAQs)

V5 Inc Exc PS shows how much money a company earns per share from its normal business. It removes one-time or unusual events so investors can see the company’s real performance without confusion.

For investors, V5 Inc Exc PS helps judge whether a company is truly profitable. It focuses on stable earnings, not temporary gains, making it useful for long-term investment decisions.

V5 Inc Exc PS is often more reliable than EPS because it excludes exceptional items. EPS may look high due to one-time income, while V5 Inc Exc PS reflects consistent earnings.

Exceptional items are excluded because they do not happen regularly. Removing them helps show a clearer picture of how the business performs during normal operations.

Yes, beginners can easily use V5 Inc Exc PS. It simplifies earnings analysis and helps new investors avoid being misled by temporary profit changes.

Disclaimer:The information provided in this article is for educational and informational purposes only. V5 Inc Exc PS explanations are based on general financial concepts and publicly available knowledge. This content does not constitute financial, investment, or legal advice. Readers should verify data independently and consult qualified professionals before making investment decisions. We are not responsible for any financial loss, misinterpretation, or actions taken based on the information shared on this page.

You May Also Like: 2RSB9053 Bearing Guide: Specs, Applications & Maintenance Tips

For More Information, visit newsreflect